pa local tax due dates 2021

IT 1140 Annual. Taxpayers who make estimated income tax payments should continue to follow their same filing schedule including taxpayers with estimated tax payments due on April 15 2021.

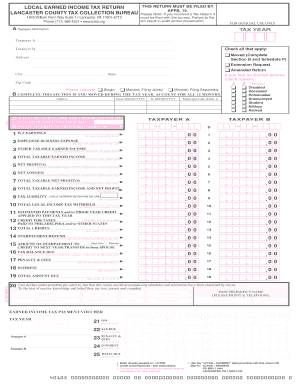

Lctcb Form Fill Out And Sign Printable Pdf Template Signnow

FORM TAX TYPE TAX PERIOD DUE DATE.

. Estimate due dates are. IT 1041 Annual IT 4708 Annual. On or Before May 6 2022.

The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated. LS-1 Local Service Tax 06 2. Tax bills are always due.

Or file a 2021 pa tax return by. 10 Penalty After November 7 2022. Use e-Signature Secure Your Files.

The postmark determines date of mailing. Tax liability due for the same month of the preceding year. Face Due Date Monday November 7 2022.

Discount Due Date Tuesday September 6 2022. April 30 - Last day to pay under discount period. Harrisburg PA Pennsylvania collected 29 billion in General Fund revenue in August which was 638 million.

The 15th day of the fourth month following the close of the entitys tax year. Tax bills were due September 1 2021. Prepayments are due by the 20th of the current month and returns for the period are due on or by the 20th of the following month.

May 7th July 8th 2022. The department of revenue thursday announced the deadline for taxpayers to file their 2020 pennsylvania. Keystone collections said today the local earned income tax filing deadline has not been extended beyond the april 15 2021 due date.

December 31 - Last day to pay. Revenue Department Releases August 2022 Collections. PT Parking Tax 06 June July 15.

Exact due dates for 2021 Wage Tax filings and payments. In addition the deadline for filing local tax returns and making local income tax payments may still be today April 15 2021. Or File a 2021 PA tax return by March 1 2022 and pay the total tax due.

The Northampton County 2021 tax bills have been mailed. June 30 - Last day to pay under face amount period. The department of revenue thursday announced the deadline for taxpayers to file their 2020 pennsylvania.

Ferguson Township 2022 Real Estate Tax Due Dates. Interest will not begin until after January 5 2022. Pennsylvanians should check with their local.

AT Amusement Tax 06 June July 15. July 9th December 31st 2022. 5 17 Tax Deadline 報稅最後期限延至5月17日in 2021 Tax Deadline Income Tax Deadline Tax Day Pt X8hafn1h5em Pennsylvania Department Of Revenue Parevenue Twitter.

Try it for Free Now. Pay all of the estimated tax by Jan. Ad Upload Modify or Create Forms.

Nd Qtr April-May-June July 31. 2021 Wage Monthly and Quarterly Tax Due dates PDF. In this case 2021 estimated tax payments are not required.

Download Or Email PA-40 More Fillable Forms Register and Subscribe Now.

Work Opportunity Tax Credit Statistics For Pennsylvania Cost Management Services Work Opportunity Tax Credits Experts

When Are Taxes Due In 2022 Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/pmn/5HGIEYMH75DNDA6GRD4TJ5RI6A.jpg)

Live In Pa Or N J Irs Extends Tax Filing Deadline To Feb 15 For Victims Of Hurricane Ida

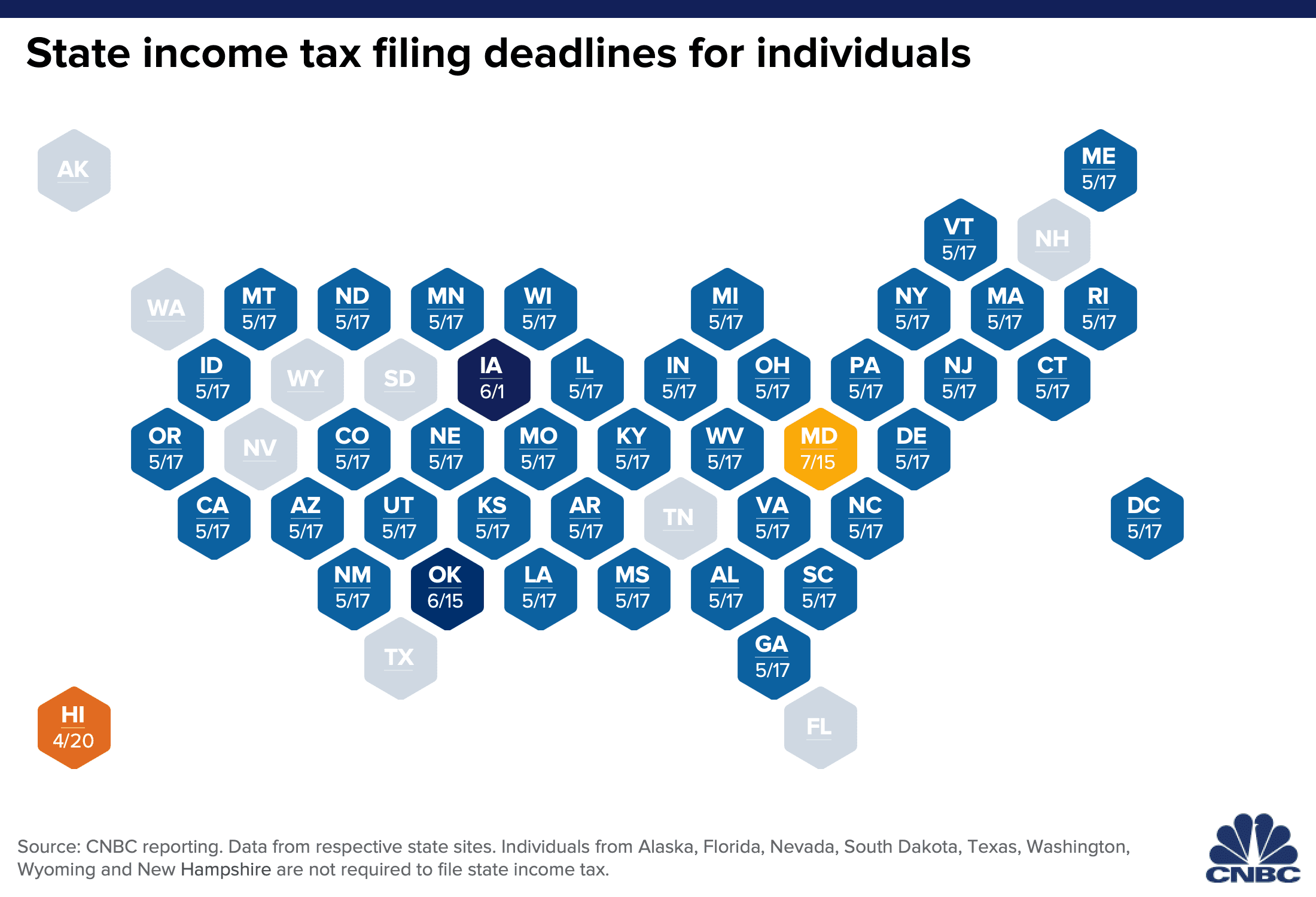

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

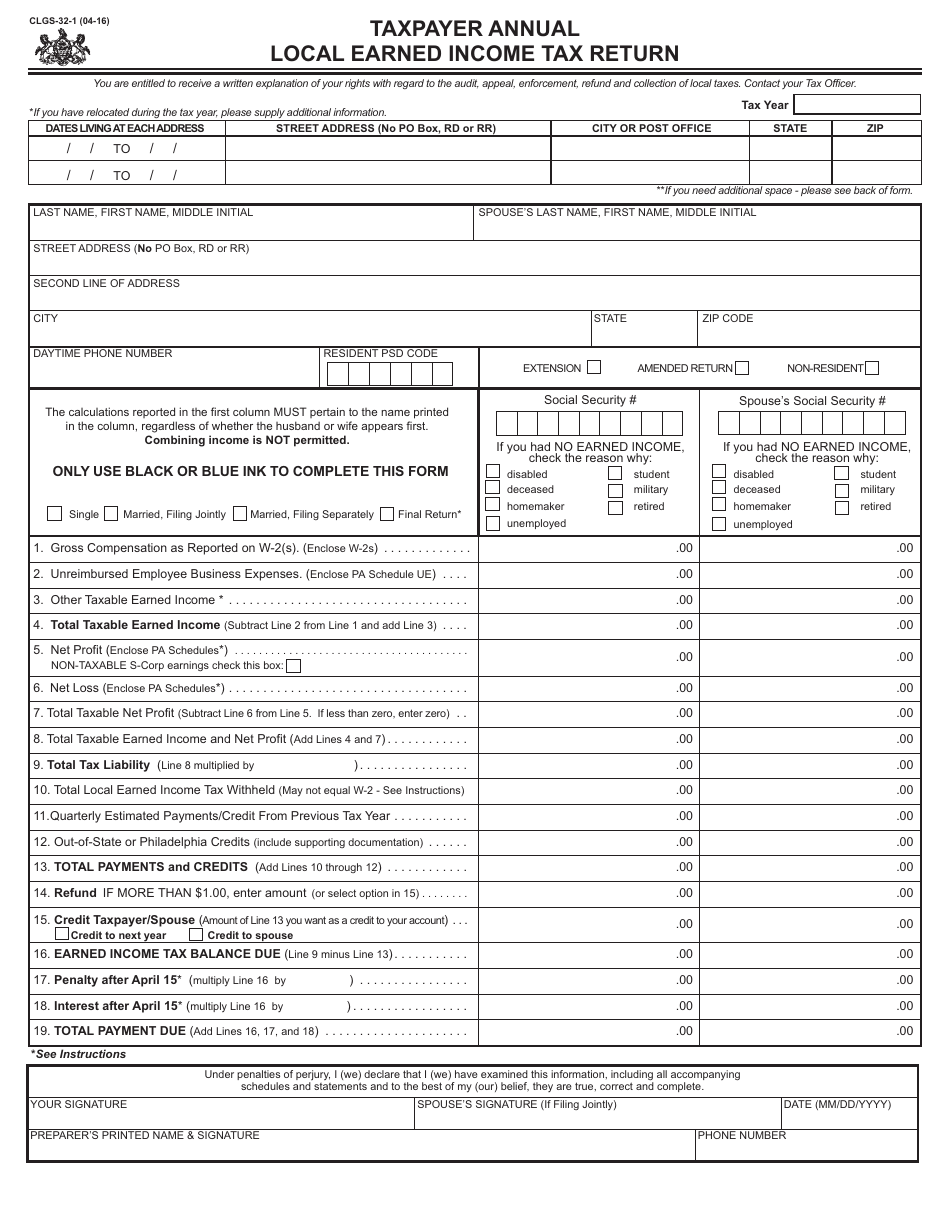

Act 32 Local Income Tax Psd Codes And Eit Rates

State Income Tax Deadlines In 2020 New Due Dates

State Corporate Income Tax Rates And Brackets Tax Foundation

Deadline Extended For Pa Federal Income Tax Filing For Individuals

Form Clgs 32 1 Download Fillable Pdf Or Fill Online Taxpayer Annual Local Earned Income Tax Return Pennsylvania Templateroller

Pennsylvania Taxpayers Encouraged To Use New Online Filing System For Pa Tax Returns Explorevenango Com

City Treasurer City Of Erie 2020 School Property Taxes Are In The Mail Wjet Wfxp Yourerie Com

Grove City Tax Office Pa Home Facebook

State Local Tax Burden Rankings Tax Foundation

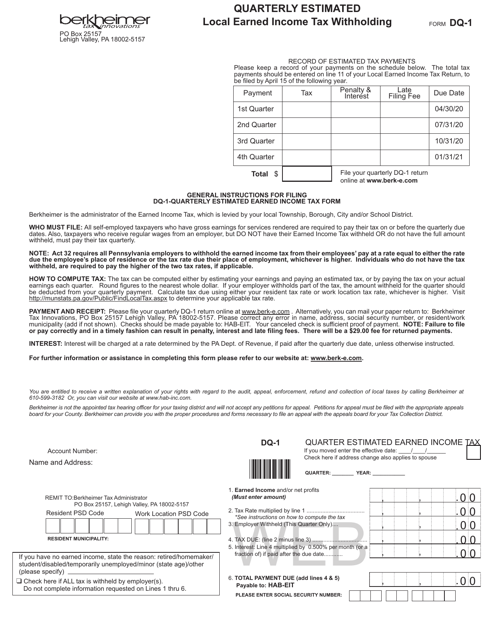

Form Dq 1 Download Fillable Pdf Or Fill Online Quarterly Estimated Local Earned Income Tax Withholding 2021 Pennsylvania Templateroller

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes